Fed Rate Hikes: Impact on US Savings Accounts (2025 Update)

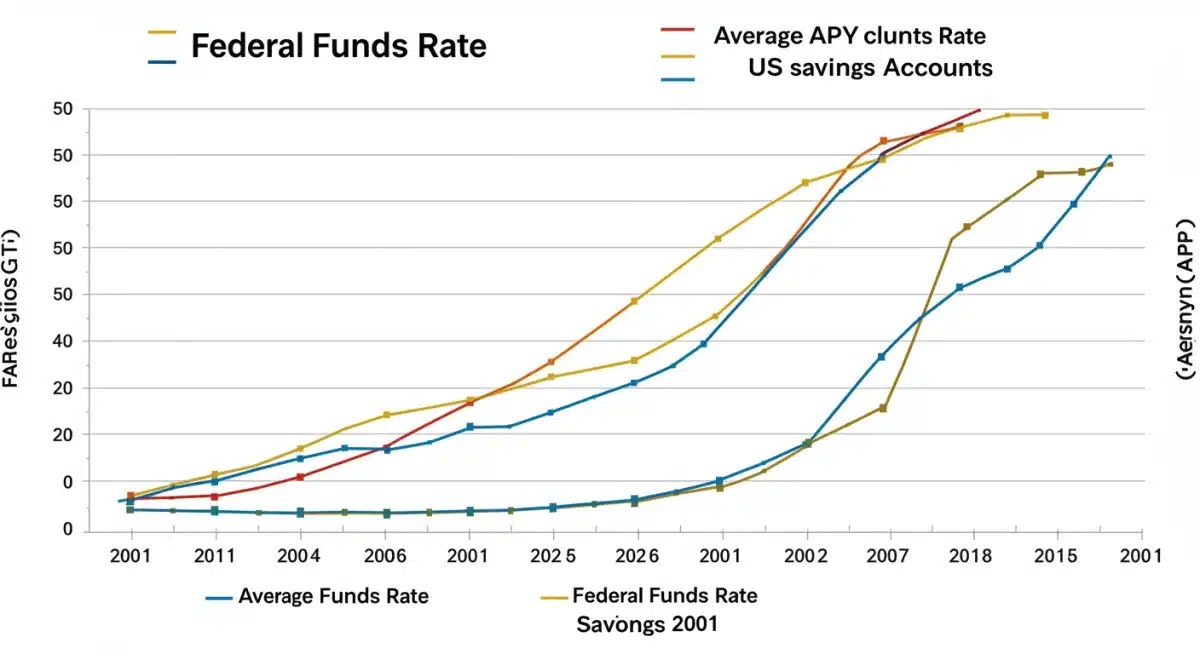

The latest Federal Reserve rate hikes significantly affect US savings accounts, generally leading to higher annual percentage yields (APYs) for savers, making it crucial to understand these policy shifts for maximizing financial returns.

Understanding the Latest Fed Rate Hikes: How Current Monetary Policy Impacts US Savings Accounts (RECENT UPDATES) is essential for anyone looking to optimize their personal finances in today’s economic climate. The Federal Reserve’s decisions directly influence the interest rates banks offer, and consequently, the growth potential of your hard-earned savings. Let’s delve into how these recent adjustments might be shaping your financial future.

The Federal Reserve’s Role in Monetary Policy

The Federal Reserve, often referred to as the Fed, serves as the central bank of the United States. Its primary mandate involves maintaining price stability, maximizing employment, and ensuring moderate long-term interest rates. To achieve these goals, the Fed utilizes various tools, with interest rate adjustments being one of the most prominent. These adjustments ripple through the entire economy, affecting everything from consumer borrowing costs to the returns on savings accounts.

When the Fed decides to raise interest rates, it typically does so to curb inflation, which occurs when the general price level of goods and services rises. By making borrowing more expensive, the Fed aims to slow down economic activity, thereby cooling demand and reducing inflationary pressures. Conversely, lowering rates is intended to stimulate economic growth during periods of recession or slow expansion.

Key Instruments of the Fed

The Federal Funds Rate is arguably the most influential interest rate set by the Fed. It’s the target rate for overnight lending between banks. While the Fed doesn’t directly control this rate, it guides it through open market operations, such as buying and selling government securities. Changes to the Federal Funds Rate directly impact other interest rates throughout the economy.

- Discount Rate: The interest rate at which commercial banks can borrow money directly from the Federal Reserve.

- Reserve Requirements: The amount of funds banks must hold in reserve against deposits.

- Open Market Operations: Buying or selling government bonds to inject or withdraw money from the banking system.

Understanding these mechanisms is crucial for appreciating the broader economic implications of the Fed’s decisions. Each tool plays a specific role in influencing the money supply and credit conditions, ultimately affecting how much you earn on your savings.

In essence, the Fed acts as the economy’s thermostat, fine-tuning interest rates to keep inflation in check and foster sustainable growth. Its actions are under constant scrutiny, and for good reason, as they directly influence the financial well-being of millions of Americans, particularly those with savings accounts.

Understanding Recent Fed Rate Hike Cycles

In recent years, the Federal Reserve has embarked on a series of significant interest rate hikes, marking a departure from the low-interest-rate environment that characterized much of the 2010s. These increases were primarily a response to persistently high inflation, which reached levels not seen in decades. The Fed’s objective was to cool down an overheating economy and bring inflation back to its target of 2%.

The specific timing and magnitude of these hikes are determined by the Federal Open Market Committee (FOMC), which meets eight times a year to assess economic conditions and make policy decisions. Each hike typically involves a quarter-point (25 basis points) increase, though larger adjustments have occurred during periods of heightened concern.

Driving Factors Behind the Hikes

Several factors have contributed to the recent need for rate increases. Supply chain disruptions, exacerbated by global events, led to shortages and higher prices. Robust consumer demand, fueled by fiscal stimulus and a strong labor market, also put upward pressure on prices. The Fed’s response was a deliberate effort to rebalance supply and demand.

- Inflationary Pressures: Surging consumer prices across various sectors.

- Strong Labor Market: Low unemployment rates and rising wages contributing to demand.

- Geopolitical Events: Global conflicts impacting energy and commodity prices.

These rate hikes are not arbitrary; they are carefully considered responses to complex economic dynamics. While intended to stabilize the economy, they also have direct consequences for individual savers and borrowers, altering the financial landscape for households across the nation.

The cycle of rate hikes represents a pivotal moment in monetary policy, shifting the cost of money and credit. Savers, in particular, have a vested interest in understanding these adjustments, as they directly influence the potential returns on their deposited funds. Staying informed about the Fed’s trajectory is key to making informed financial decisions.

Direct Impact on US Savings Accounts

One of the most immediate and tangible effects of the Fed’s rate hikes is on US savings accounts. When the Federal Reserve raises its benchmark interest rate, commercial banks typically follow suit by increasing the Annual Percentage Yields (APYs) they offer on various deposit products, including savings accounts, money market accounts, and certificates of deposit (CDs).

This happens because banks can earn more on their own investments, and to attract deposits, they need to offer competitive rates to customers. For savers, this translates into higher returns on their funds, allowing their money to grow faster over time without taking on additional risk. It’s a direct benefit for those who prioritize liquidity and capital preservation.

Comparing Savings Options

Not all savings accounts respond to Fed rate hikes in the same way. Traditional brick-and-mortar banks might be slower to adjust their rates, while online banks and credit unions often offer more competitive APYs due to lower operating costs. This disparity means that savers who actively seek out the best rates can significantly outperform those who stick with their primary bank without comparison shopping.

- Online Savings Accounts: Generally offer higher APYs and respond quickly to rate changes.

- Money Market Accounts: Combine features of checking and savings, often with tiered interest rates.

- Certificates of Deposit (CDs): Offer fixed rates for a set term, potentially locking in higher returns.

The impact of rising rates also highlights the importance of understanding the difference between nominal interest rates and real interest rates. While nominal rates on savings accounts may increase, if inflation remains high, the real return (adjusted for inflation) might still be negative or negligible. This underscores the need for a holistic view of personal finance.

Ultimately, the Fed’s rate hikes present a unique opportunity for savers to earn more on their deposits. However, it requires active engagement and research to identify the accounts offering the most attractive APYs, ensuring your money works as hard as possible for you.

Navigating Your Savings in a Rising Rate Environment

A rising interest rate environment, while generally beneficial for savers, also presents a strategic landscape that requires careful navigation. Simply leaving your money in a low-yield account could mean missing out on significant potential earnings. Proactive steps can help maximize the benefits of these economic shifts.

One of the first actions savers should consider is reviewing their current savings accounts. Check the APY your bank is offering and compare it with rates from other institutions, especially online banks. The difference could be substantial over time. Don’t be afraid to switch banks if a better offer is available, as the process has become much simpler with digital banking.

Strategies for Maximizing Returns

Beyond simply finding a high-yield savings account, there are several strategies you can employ to make the most of rising rates. These include laddering CDs or exploring money market accounts that offer competitive, variable rates. Each option comes with its own set of advantages and considerations regarding liquidity and term length.

- Shop Around: Consistently compare APYs across different banks and credit unions.

- Consider Online Banks: They often have lower overheads and can offer higher rates.

- CD Laddering: Staggering CDs with different maturity dates to balance liquidity and higher rates.

- Money Market Accounts: Explore these for potentially higher rates than traditional savings, often with check-writing privileges.

It’s also important to maintain an emergency fund in a highly liquid and accessible account, even if it means a slightly lower APY. The primary purpose of an emergency fund is security, not aggressive growth. However, any funds beyond your immediate emergency needs can be strategically placed to earn more.

Navigating this environment successfully means staying informed and being willing to adjust your financial strategy. The goal is to ensure that your savings are not just sitting idle but actively contributing to your financial goals in a way that aligns with the current monetary policy landscape.

Indirect Economic Effects and Broader Implications

While the direct impact on savings accounts is clear, Fed rate hikes also trigger a cascade of indirect economic effects that influence the broader financial landscape. These effects can, in turn, subtly shape consumer behavior, investment decisions, and the overall stability of the economy, eventually circling back to affect individual financial well-being.

For instance, higher interest rates make borrowing more expensive for businesses and consumers alike. This can lead to a slowdown in spending and investment, which is precisely what the Fed aims for when fighting inflation. Mortgage rates tend to rise, impacting the housing market by making homeownership less affordable and potentially cooling demand.

Impact on Other Financial Products

The ripple effect extends to various other financial products and sectors:

- Credit Card Interest: Variable-rate credit cards typically see their interest rates increase, making carrying a balance more costly.

- Auto Loans: New car and used car loan rates may also climb, affecting purchasing power.

- Stock Market Volatility: Higher rates can sometimes lead to stock market volatility as investors reassess corporate earnings and growth prospects.

- Bond Yields: New bonds issued often offer higher yields, making them more attractive to investors seeking fixed income.

These broader implications mean that while your savings account might be earning more, other aspects of your financial life could be affected. It’s a delicate balancing act, and the Fed’s decisions aim to optimize the overall health of the economy, even if it means trade-offs in certain areas.

Understanding these indirect effects allows for a more comprehensive view of the economic environment. It empowers individuals to make informed decisions not just about their savings, but about their borrowing, investments, and overall financial planning in response to evolving monetary policy.

Future Outlook and What Savers Should Monitor

The future trajectory of Fed rate hikes is always subject to economic data, making it crucial for savers to remain vigilant and adaptable. While the Fed has indicated its commitment to bringing inflation under control, future decisions will depend on key economic indicators, such as inflation rates, employment figures, and global economic stability.

Economists and market analysts constantly forecast the Fed’s next moves, but these are merely predictions. Actual policy decisions are data-dependent and can change rapidly. This uncertainty means that a static approach to savings might not be the most effective in the long run.

Key Indicators to Watch

For savers looking to stay ahead, monitoring specific economic data points can provide valuable insights into potential future Fed actions:

- Consumer Price Index (CPI): A key measure of inflation, indicating the rate of price changes for consumer goods and services.

- Personal Consumption Expenditures (PCE) Price Index: The Fed’s preferred measure of inflation.

- Unemployment Rate: A strong labor market might give the Fed more room to raise rates.

- GDP Growth: Indicators of economic output can influence policy decisions.

- FOMC Meeting Minutes: Released periodically, these provide insights into the Fed’s thinking and future plans.

As the economic landscape evolves, the Fed’s stance on interest rates may shift. This could mean periods of continued hikes, pauses, or even eventual rate cuts if economic conditions warrant. For savers, this dynamic environment emphasizes the importance of regularly reviewing savings strategies and adjusting them as needed.

Staying informed about these indicators and the Fed’s communications is paramount. It allows savers to anticipate changes, react strategically, and ensure their financial plans remain aligned with the prevailing monetary policy, ultimately safeguarding and growing their wealth.

| Key Aspect | Description |

|---|---|

| Fed’s Primary Role | Manages monetary policy to achieve price stability, maximum employment, and moderate long-term rates. |

| Impact on Savings | Higher Fed rates generally lead to increased APYs on savings accounts, benefiting savers. |

| Savers’ Strategy | Compare rates, consider online banks, and explore CD laddering for optimized returns. |

| Economic Indicators | Monitor CPI, PCE, unemployment, and GDP for insights into future Fed policy changes. |

Frequently Asked Questions About Fed Rate Hikes

The Federal Reserve primarily raises interest rates to combat inflation. By making borrowing more expensive, the Fed aims to slow down economic activity, reduce consumer demand, and consequently bring rising prices back to a stable level, typically targeting around 2% inflation.

The response time varies by institution. Online banks and credit unions often adjust their savings account rates more quickly and offer higher APYs compared to traditional brick-and-mortar banks. It’s advisable to compare rates regularly to ensure your savings are earning competitively.

No, not all savings accounts are affected equally. High-yield savings accounts and money market accounts typically see more significant and quicker increases in their APYs. Traditional savings accounts at large banks may see smaller, slower adjustments. CDs also benefit, but their rates are fixed for the term.

During a rising rate environment, it’s wise to shop around for the highest Annual Percentage Yields (APYs). Consider moving funds to high-yield online savings accounts or exploring Certificate of Deposit (CD) ladders to lock in better returns while maintaining some liquidity. Regularly review your options.

Yes, Fed rate hikes have broad implications. They typically lead to higher interest rates on credit cards, mortgages, and auto loans, making borrowing more expensive. They can also influence stock market performance and bond yields, affecting overall investment strategies and consumer spending patterns.

Conclusion

The Federal Reserve’s recent rate hikes are a powerful tool in managing the nation’s economy, and their impact on US savings accounts is a clear example of monetary policy at work. For American savers, these adjustments represent a dual opportunity and a call to action. On one hand, higher rates offer the potential for enhanced returns on deposits, a welcome change after years of historically low yields. On the other hand, it necessitates a proactive approach to personal finance, encouraging individuals to seek out the most competitive rates and to understand the broader economic implications. By staying informed about the Fed’s decisions and actively managing their savings strategies, individuals can effectively navigate this evolving financial landscape and maximize their financial well-being.